Inflation has become a significant concern for investment professionals and their clients. Stocks have fallen as the future earnings projections of numerous companies no longer seem as attractive to investors. Not only this but rising costs for sets from fuel to groceries to housing have everyone rattled and worrying all about their financial future, sending ripples of fear through the markets.

Having a well diversified portfolio is definitely among the most crucial rules in investing, in this inflationary environment, it's more important than ever. Normally, diversification acts as a form of insurance policy on your own portfolio, in this environment, having assets that don't move in tandem with industry will protect investors and supercharge their returns.

US Debt: A Catalyst for Inflation

The connection between a nation's debt and the resulting inflation is inescapable. As illustrated by the recent US long-term budget outlook, the deficit is on a trajectory to cultivate, putting more stress on the economy.

Recent events have once more shown that the US is brushing against its debt ceiling, signaling potential economic challenges. This rising deficit is directly proportional to the mounting inflation, urging investors to reconsider their traditional approaches.

The Ripple Effect of Market Volatility

An immediate consequence of inflation is its impact on market volatility. The original portfolio was constructed with a 60/40 split between stocks and bonds for a long time. This strategy was underpinned by the negative correlation between stocks and bonds, meaning when one fell, the other would rise, creating a safety net.

However, this correlation has shifted from negative to positive. Now, when stock prices fall, bonds are following suit. This turn of events renders the traditional 60/40 strategy obsolete, pushing investors to consider beyond the tried and true.

The Power of Diversification

The volatility in this market necessitates the exploration of alternative investments offering uncorrelated returns. Doing a multi-strategy portfolio is going to be beneficial, especially when the focus spans across real-estate, CTAs & commodities, and relative-value strategies. Such a diversified approach has historically produced returns that don't mirror the broader market, ensuring a way of measuring safety against market downturns.

Addressing Liquidity Concerns in Alternatives

A standard reservation about alternative investments is their perceived illiquidity. However, this notion doesn't hold true across the board.

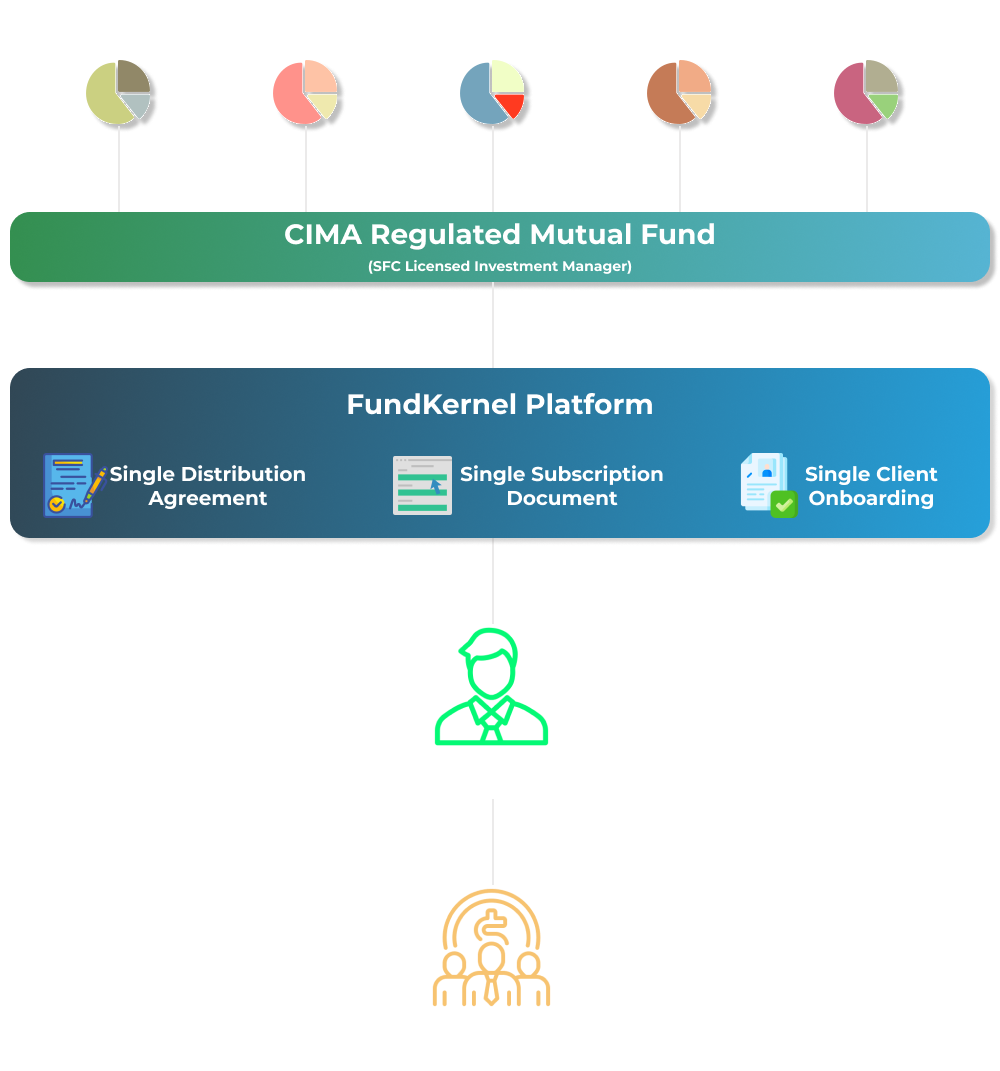

Enter FundKernel's curated choice of liquid alternatives. These investment solutions provide the most effective of both worlds: they offer the high, uncorrelated returns that alternatives are known for, combined with accessibility of monthly or quarterly liquidity options. For investors, this combination means a shield against inflation-induced volatility and the flexibility to gain access to funds when needed.

Act Now to Shelter Your Investments

The warning signs are clear. With inflation poised to persist and traditional portfolio strategies showing cracks, the full time to behave is now. By diversifying into well-selected alternative investments, financial advisors can better position their clients' portfolios to weather the challenges ahead. And with platforms like FundKernel, ensuring this diversification while maintaining liquidity never been easier. Safeguard your client's future. Embrace the alternatives today.

For more info you should click on this kind of link wealth management.